We’re pleased to have advised Xaar plc, the leading inkjet printing technology group, on its acquisition of Megnajet Limited and Technomation Limited (which together trade as Megnajet), in a combined £4.0 million deal.

FRP’s Financial Advisory team support Xaar plc, a printing technology group, on it’s key growth acquisition

Lead financial and tax due diligence adviser to leading inkjet printing tech group, Xaar plc, on its acquisition of Megnajet

Background

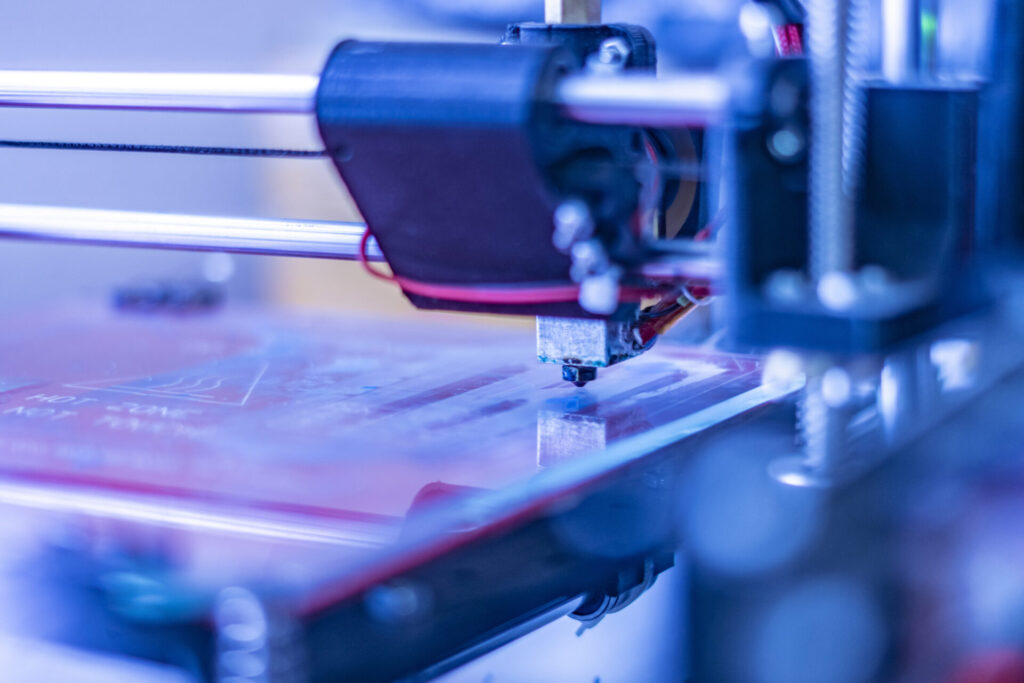

Headquartered in Cambridge, Xaar is a market leader in the development of inkjet technology. Its technology is used in a broad range of print applications, such as wide-format graphics, labels, ceramic tile decoration and advanced manufacturing, exporting more than 85% of its production to clients worldwide. The company had identified Kettering-based Megnajet Limited and Technomation Limited (trading together as Megnajet) as a potential acquisition, and engaged FRP to advise on the deal.

Kettering-based Megnajet specialises in the design and manufacture of industrial ink delivery systems. Its product range includes once of the most integrated and compact ink management and supply systems on the market, which enables its customers to reduce development timescales and increase the speed at which they can go to market.

Action

FRP’s Financial Advisory team, led by Director Joanne Price was engaged to provide financial and tax due diligence services. Supported by, Corporate Finance Partner, Chris Adlam and Director, Matt Field, the team worked collaboratively with Xaar, Megnajegt and the other buy-side advisers to successfully facilitate the transaction, support commercial negotiations and ensure a positive outcome for all parties involved.

Outcome

Xaar successfully acquired Megnajet in a £4 million deal that will accelerate the company’s growth strategy by enabling the business to offer existing and new customers a more integrated inkjet solution. Megnajet’s products will form part of the end-to-end solution helping Xaar’s UDI (User Developer Integrator) customers reduce their development timescales and shorten their time to market, while attracting a broader range of commercial opportunities for Xaar.

Commenting on the deal, Joanne Price said: “Xaar is a fantastic group and it’s been a pleasure to support the team on such an important acquisition. There are many synergies between these businesses, not only do they have deep roots in innovation and technical expertise, they are also committed to providing customers with the highest quality service. This transaction creates a very strong foundation for future growth and I’m looking forward to seeing the group continue to develop on the next stage of its journey.”

John Mills, CEO of Xaar said: “The acquisition of Megnajet will accelerate our growth strategy by enabling us to offer existing and new customers a more integrated inkjet solution. Having worked with Megnajet for several years we know the company has an excellent reputation within the inkjet industry for delivering compact and easy to integrate products. This acquisition is a great addition to our business and we are delighted to welcome everyone at Megnajet into the Xaar Group.”

This transaction creates a very strong foundation for future growth and I’m looking forward to seeing the group continue to develop on the next stage of its journey.