Our Forensic Services specialists explore their expectations for the year ahead

The future of forensics: 2025 predictions

Henry Pocock: Transaction disputes

The saying “marry in haste, repent at leisure” sums up my prediction for 2025, where I am expecting to see a rise in the number of M&A-related disputes.

The rush to complete corporate transactions before the Autumn Budget announcement meant due diligence processes were accelerated, and purchase price mechanisms and warranties agreed quickly.

While locked box remains widely used, many of these transactions will include earn-out mechanisms to bridge “value gaps” between buyer and sellers. Earn-outs can often be contentious, especially if the buyer discovers aspects of the target business that, had they known about pre-deal, might have resulted in a lower purchase price.

As earn-out periods conclude during 2025 I expect there to be a demand for forensic accounting reviews as buyers prepare their calculations and sellers review the outcome. This will inevitably lead to disputes and, in some cases, the need for expert determination.

Given the typical length of warranty periods we might not see claims until next year, however buyers should remain alive to the possibility of breaches and ensure they comply with any notification requirements.

Chris Osborne: Commercial litigation

In 2024, although we have been very busy with managing litigation matters, there has been a decline in new claims issued in the Commercial Court. Anecdotally, we are seeing clients opting to use arbitration as a dispute forum rather than through the High Court, perhaps due to the costs and delays in scheduling trials in the Commercial Court.

I anticipate geopolitics will inevitably play a part in litigation assignments over the next few years. A second Trump administration could drive a number of disputes:

- assuming there is a cessation in the Ukraine-Russia conflict, I anticipate we will start seeing an increase in disputes pertaining to Ukraine;

- more disputes emanating from the Middle East – especially construction related disputes; and

- contractual disputes if, as is threatened, the US administration imposes tariffs on foreign countries.

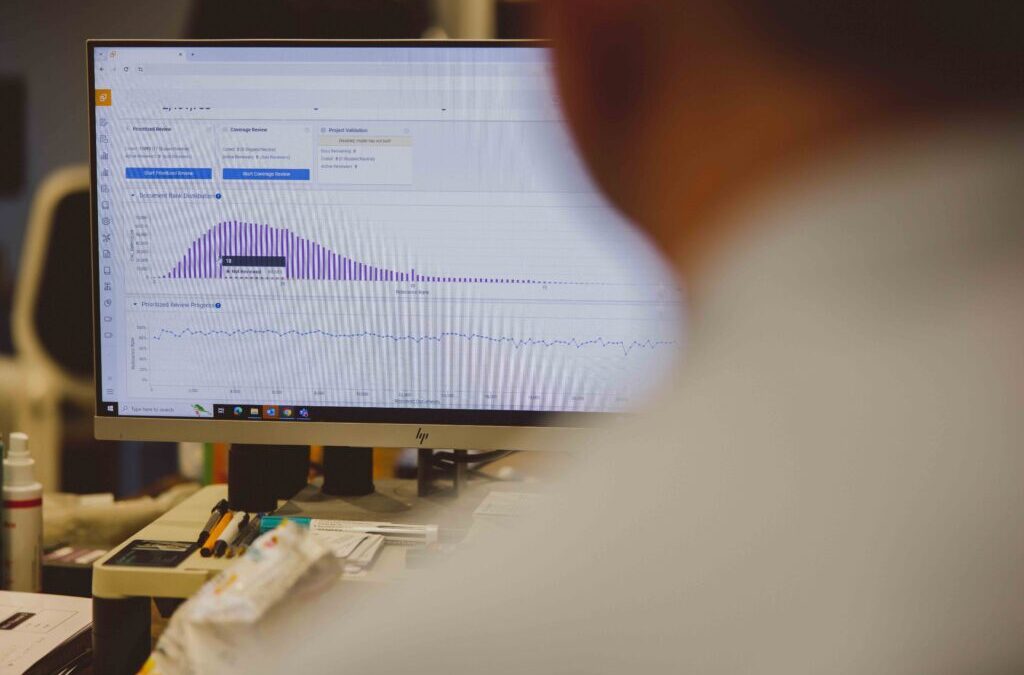

Adrian Coates: e-Discovery

In 2025, I believe that the eDiscovery industry will witness an even deeper integration of AI and machine learning technologies. Building on the momentum from 2024, where Large Language Models (LLMs) began to play a significant role, the industry will see these technologies becoming more sophisticated and integral to the eDiscovery process. AI will not only assist in document review but also in predictive coding, data classification, and anomaly detection. This will lead to more efficient and accurate eDiscovery processes, reducing the time and cost associated with legal discovery. Additionally, AI-driven analytics will provide deeper insights into data patterns, helping legal teams to strategise more effectively.

As communication channels continue to evolve, the types of data that we find will become more diverse. In 2025, there will be a significant focus on the efficient handling of data from various sources such as social media, collaboration tools (e.g. MS Teams and Slack), and messaging apps (e.g. WhatsApp and Signal). The industry will develop more advanced tools and workflows to process, review, and produce these data types. This will include better ways to manage metadata, ensuring that the context of communications is preserved, and that data is easily searchable. Legal teams will need to stay abreast of these advancements to ensure compliance and to leverage these tools effectively.

Harry Trick: Data breach and cyber incident response

With a growing amount of sensitive data being processed daily, responding to data breaches will become even more critical in the UK in 2025. Regulatory requirements, such as those outlined by the Information Commissioner’s Office, will continue to evolve, necessitating robust incident response measures. eDiscovery tools will play a pivotal role in addressing breaches swiftly and effectively. These tools will include advanced detection techniques to identify breaches early, secure data transfer protocols to protect information during investigations, and stringent access controls to prevent further unauthorised access.

Moreover, eDiscovery solutions will facilitate the rapid identification and notification of potentially affected parties. By leveraging AI and machine learning, these tools will quickly analyse vast amounts of data to pinpoint compromised information and assess the scope of the breach. Legal teams will be able to generate detailed reports and notifications in compliance with UK data protection regulations, such as the GDPR. Collaboration between legal, IT, and security professionals will be essential to develop and maintain comprehensive incident response strategies, including regular breach simulations and detailed response plans. This proactive approach will help organisations minimise damage, maintain trust, and ensure regulatory compliance in the event of a data breach.

Rob Whitefoot: Business valuations

The last year has seen numerous cases where I have been instructed to update previously issued valuation opinions, often focusing on the ‘post-Covid’ recovery period, where results are now more certain. In addition, following the Budget in October 2024, I have also seen an increase in instructions as a result of changes to CGT rates.

As the dust settles, I am predicting further fallout from the Budget, not only as a result of the CGT rate changes but also the longer-term impact of reforms to Business Property Relief (‘BPR’) and the related inheritance tax position for the estates of business owners, who now find themselves in a position where they need to know the value of their business for tax planning purposes.

I anticipate that the BPR changes will also result in business owners changing their longer-term planning focus. Where previously they may have had no intention of selling the family business as it was protected from inheritance tax, this is now a more likely option. Relating this back to family court instructions, I expect to see an increased focus on the need for expert opinion in relation to the likely costs of disposal of a business and alternative sale structures. Such enquiries are often difficult to answer, with no two transactions being the same, however, having a Corporate Finance team at FRP helps greatly in being able to consider ‘real life’ situations and provide expert opinion on such matters.

Matt Field: Business valuations – tax aspects

Picking up on Rob Whitefoot’s comments, I am frequently asked to comment (typically in matrimonial cases) on how one spouse can realise or separate the capital value of shares in a company, tax efficiently, whilst the other spouse retains their shares.

This essentially involves considering ‘internally devised’ structures, which typically do not involve a third party acquirer or indeed new additional cash resources. By way of example, we will comment, initially at a high-level on the viability of options such as, a company purchase of its own shares, an alternative ‘Newco’ acquisition structure, or a demerger to achieve the objective for both parties.

The recently announced changes to the BPR legislation are also specifically relevant in a divorce planning scenario, where the ability of a ‘couple’ to defer an IHT charge under the inter-spouse transfer rules is no longer applicable. Linked to this, although not necessarily a matter which would typically impact my work, is the role that life insurance will play in the mitigation of a business owners inheritance tax exposure.

I expect to see an increase in enquiries in all these areas as changes to CGT and IHT rules have an ever-increasing bearing on achieving a fair settlement for both parties and as instructing solicitors focus (quite properly) on the broader tax landscape in the settlement advice that they provide.

Faye Hall: Matrimonial cases

As an expert focussing on disputes that arise in family matters, last year I commented on the increasing focus on enabling non-court resolution for family finance matters, be it through the use of Private FDR, Mediation, Arbitration or a ‘one legal team approach.’ These options continue to be a welcome feature in fraught and contentious valuation disputes and all can be successful in achieving a resolution for the parties.

However, the unpredictable economic climate and geo-political events continue to make expert opinions on matters such as business valuations, liquidity and continuing income streams open to debate. That said, some form of agreement is vital in accomplishing a settlement between the parties. Therefore, an expert accountant can be vital in considering the complexity of the business arrangements in play and reviewing the financial information available.

While this has already become a common theme in complex family financial matters, I expect to continue to see the need for ‘shadow’ experts to advise a party in the background to enable an understanding of the matters in dispute, matters of expert opinion and often the reasonableness of the conclusions reached by another expert.

Laura Dymott: Investigations

The FRP Forensics practice has grown significantly in 2024, both in the number of team members and in the breadth of our capabilities and services we can offer. In my view this is critical to meet the vast array of investigation, litigation and arbitration matters that can benefit from forensic expertise, both in the UK and internationally. This is particularly important when certain matters require more than one skill set and collaboration is key.

2025 will in my opinion, continue to require multi discipline expertise on cross jurisdictional matters, with more opportunities coming out of offshore markets including the Caribbean and the Middle East as big-ticket litigation continues.

In the UK, I am expecting to see further enquiries seeking forensic expertise in establishing the point of insolvency of a failed company. Forensic input on insolvency matters can offer further insight in establishing merits of insolvency claims as well as quantum, something that should be considered as early as possible, not just at the time of appointing experts.

Jonathan Wheatcroft: Failure to prevent fraud legislation

As the year progresses, there will be increasing attention on the ‘failure to prevent fraud’ (“FTPF”) legislation which comes into force in September. The first charges are awaited with bated breath, especially given the SFO Director’s public statements that he intends for the SFO to be the first to prosecute under the new law. However, he could have a race on his hands – when the UK’s anti-bribery law came into force in 2011, the CPS got off the mark first with a conviction within four months.

More importantly, the first FTPF cases will be critical as they will set a baseline for the potential impact of the legislation…..not only for what could come to pass if an organisation gets it wrong, but also how the implementation of ‘reasonable procedures’ can help avoid more serious consequences.

Given the greater focus on fraud, I expect external auditors will continue to be sensitive to potential issues at the organisations they are giving opinions on. As such, I expect FRP to continue acting as an independent investigator, working closely with legal counsel, to help establish the facts and, if necessary, assist with remediation.

Alison Hollywood: Trends in insurance claims across the UK and Ireland in 2025

In 2025, I believe the insurance claims sector in the UK and Ireland will undergo significant transformation, which will impact how claims are handled, the types of claims being made, and the overall claims management process. Some of the key areas of change are as follows:

1. Increase in Business Interruption Claims Post-Pandemic

The COVID-19 pandemic highlighted vulnerabilities in many businesses, especially in sectors like hospitality, retail, and leisure. In 2025, insurers are likely to see a rise in business interruption claims as some important issues such as furlough and aggregation are tested in the Courts. Revisiting policies will be important, with so many policies unclaimed, particularly in insolvent estates.

2. Cyber Insurance Claims Surge

With the rise in cyber threats, cyber insurance claims are expected to increase significantly in 2025. As businesses across both the UK and Ireland continue to digitalise, the risk of data breaches, cyberattacks, and system outages will rise, leading to a surge in cyber insurance claims. These claims will likely centre around issues such as ransomware attacks, data theft, and system downtime.

3. Climate Change-Related Claims and Natural Disasters

The impact of climate change is becoming more evident, with rising flood, storm, and fire risks. In 2025, insurance claims related to natural disasters, especially in flood-prone areas, are anticipated to increase. Both the UK and Ireland have seen an uptick in extreme weather events, and insurance companies will be faced with a growing volume of claims related to property damage, business interruption, and environmental impacts.

4. Insurance Fraud and Investigations

Insurance fraud remains a major issue in both the UK and Ireland, and it is expected to intensify in 2025 as fraudsters exploit new opportunities, such as in cyber claims or exaggerated property damage claims linked to climate-related events. Insurers will continue to invest in sophisticated fraud detection systems, including AI-driven tools, to combat fraudulent claims.