FRP’s Debt Advisory team secured the asset-based financing package for Inspirit Capital’s acquisition of Alpha3

FRP supports Inspirit’s Alpha3 acquisition

Background

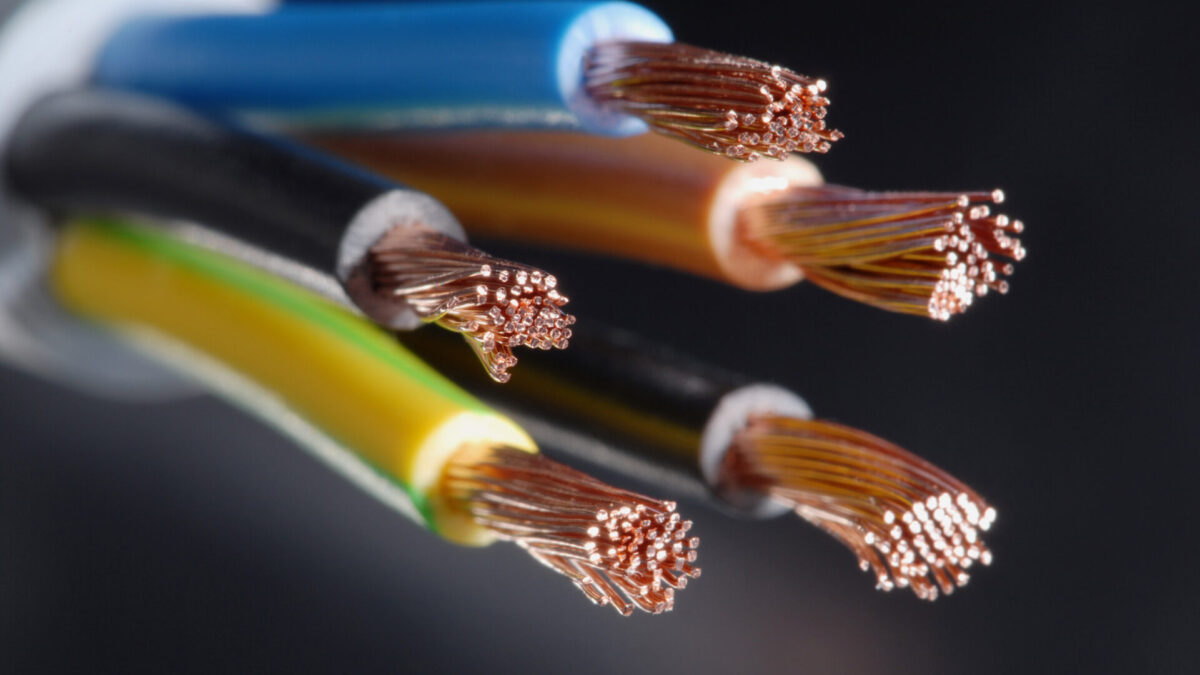

London-based investment firm Inspirit Capital was involved in a competitive auction process to acquire the Alpha3 Manufacturing group, a multi-site business, which produces complex electro-mechanical assemblies, cable harnesses and other electrical components for a range of end markets including aerospace and defence, cryogenics, healthcare, and automotive. Inspirit specialises in acquiring businesses that are no longer core to their parent company’s strategic objectives, and require a different ownership structure to achieve their full potential. Alpha3, which was being sold by a UK division of US-based Avnet group, was firmly on mandate for the investment firm. Inspirit was seeking to raise asset-based finance to support the acquisition and ongoing working capital requirements, and appointed FRP to manage the debt-raising process.

Action

FRP’s Debt Advisory team was asked to conduct a competitive debt auction to find an asset-based lender with the desire and capability to finance the transaction. Having reviewed and considered the core collateral and financial data, the team quickly identified a targeted list of lenders best placed to deliver the necessary financing structure. The focused debt-raising process resulted in two lenders with the ability to meet or exceed Inspirits key financing requirements being invited to submit board-approved terms.

Outcome

Inspirit received two highly competitive and market-leading financing offers. Following further discussions, during which both offers were further enhanced, Inspirit selected Shawbrook as its preferred financing partner, due to its structure most closely matching the original brief. The FRP team then advised Inspirit during the legal documentation stage and through to completion of the transaction.