Decision makers surveyed

Our research draws on insights from over 1,000 senior leaders across UK manufacturing, providing a comprehensive view of sector priorities.

Lenders and investors consulted

We engaged with more than 100 lenders and investors to understand funding perspectives and capital deployment trends.

Redefining Resilience: What Boards Must Prioritise for 2026

Discover the latest UK manufacturing trends shaping 2026. This report reveals how manufacturers are redefining resilience, shifting from pure financial strength to operational agility, digital transformation, and sustainability. Boards are prioritising ESG, supply chain reliability, and skills, while lenders focus on working capital and performance. Despite funding challenges, optimism remains high, with nearly 70% of leaders confident about the future. The most successful organisations will be those that invest in technology, talent, and robust execution to navigate disruption and seize new opportunities.

Demand, Margin & Orders

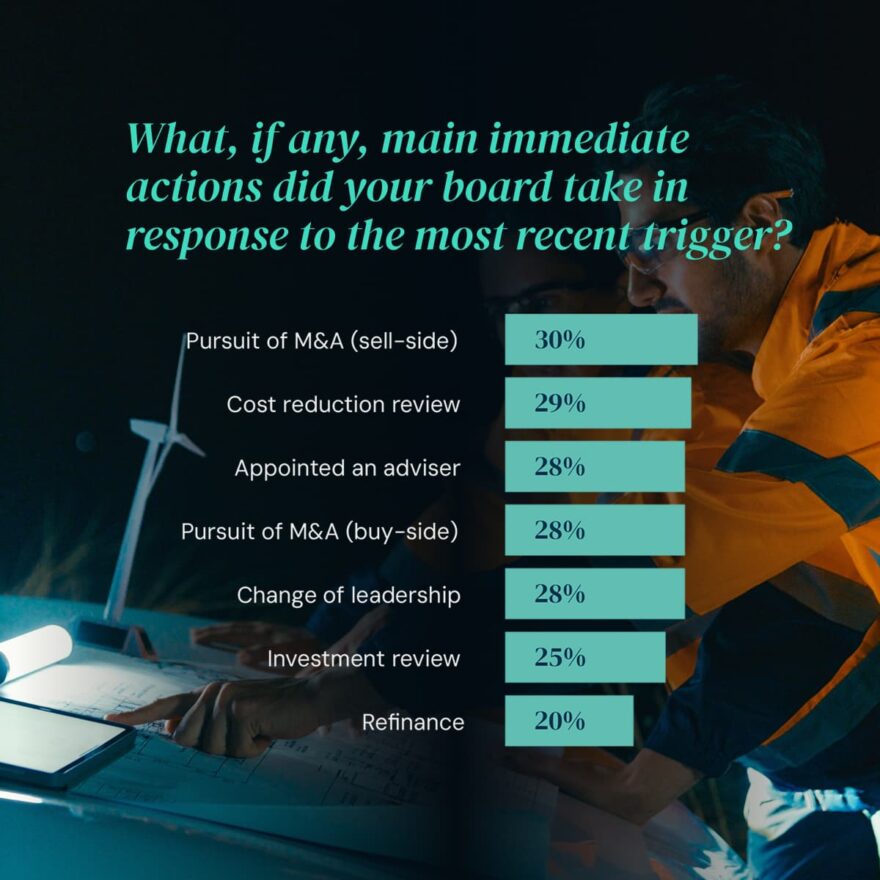

Order books remain sensitive to geopolitical shifts and supply chain disruption. 25% of boards cite trade changes and 24% highlight supply chain delays, driving renewed focus on operational flexibility.

Cost, Cashflow & Capital

44% of lenders identify working capital stress as the top risk. Boards focus on structural issues, while lenders monitor liquidity and margin erosion.

People & leadership

Leadership capability and workforce resilience are under scrutiny. 37% of lenders track staff turnover as a warning sign, while 40% of boards plan investment in skills and succession.

Investment & Digital

Automation and digital investment is accelerating. 29% of manufacturers have committed capital to new technology or R&D, with many reporting transformational impact.

Sustainability & ESG

ESG and regulatory requirements dominate board agendas. 26% of decision makers cite new obligations as a trigger for action, driving energy efficiency and supply chain transparency.