Margins in recovery

Development margins fell sharply between 2021 and 2023, but recovery is now under way as house price growth stabilises against flatter build cost inflation.

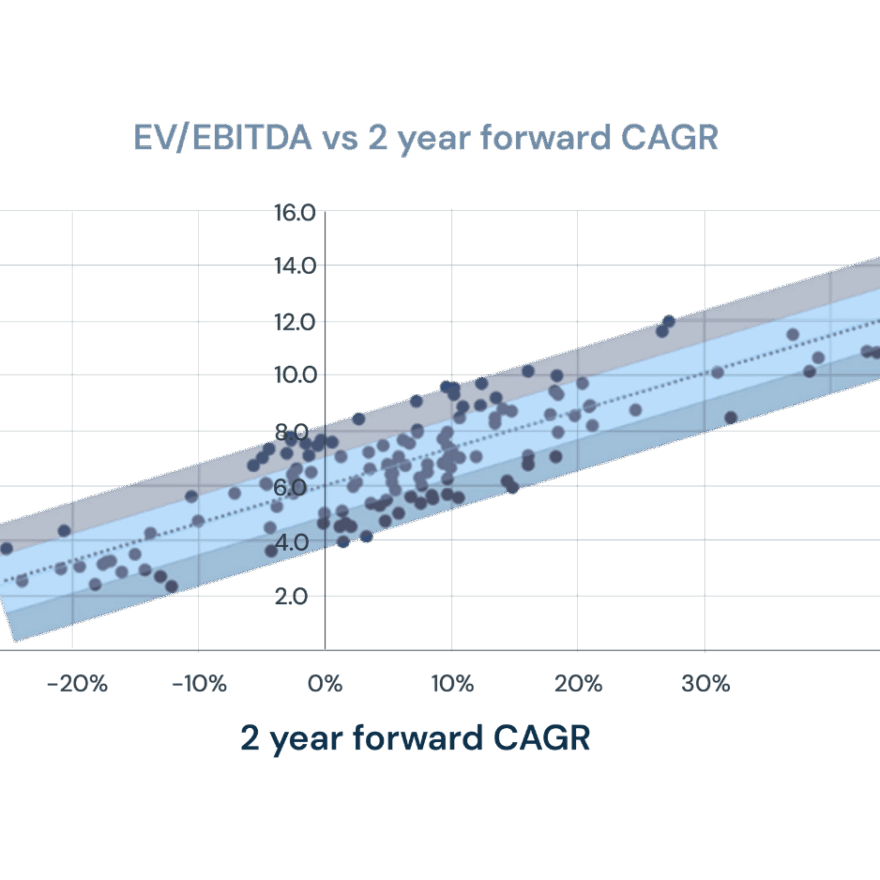

Growth credibility drives valuation

Listed housebuilders’ multiples show a 71% correlation with two-year earnings growth expectations highlighting the importance of growth credibility in valuation outcomes.

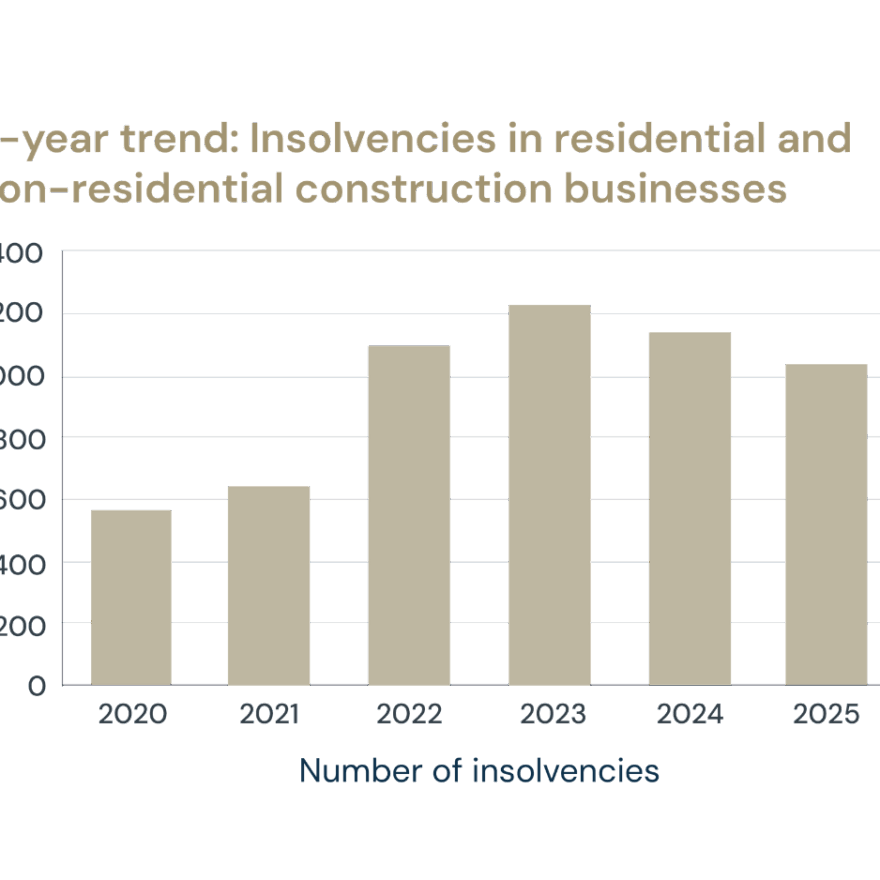

Insolvency risk for smaller operators

Insolvencies in the sector remain double 2020 levels, underlining the risk facing smaller operators.

Liquidity strains and debt pressures

Liquidity and debt costs continue to bite as companies with weaker cash conversion remain vulnerable.